Let us Help You with Your

226J Penalty Letter

The Most Comprehensive ACA Compliance Solutions for Businesses

Register for One of Our Upcoming Webinars

Navigating 2023 ACA Reporting: Expert Insights with Our Chief Legal Counsel

Date: September 21, 2023

Time: 11:00 am (CDT)

Webinar Reg Landing Page

Get Help with Your 226J Letter

226J_Landing_Short

Did you receive a 226J IRS Letter?

Are you asking yourself why did I receive this? How do I respond? It is important to understand why you received the letter and how to properly respond to the letter. Our team of experts is here to help you through the process.

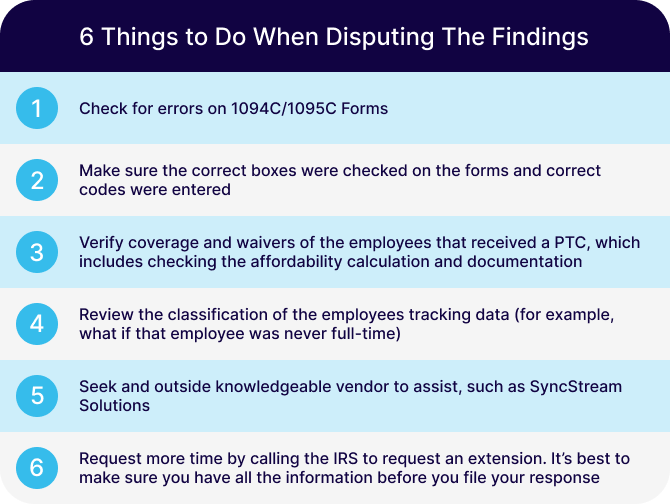

Disagree with IRS findings?

If you believe that the IRS made an error and penalties should not apply, you must respond with acceptable proof, such as copies of Form 1094-C and 1095-C. You should also request assistance from your health plan provider.