ACA 1094/1095 Series Filing Updates that Affect Small Businesses

In Conclusion

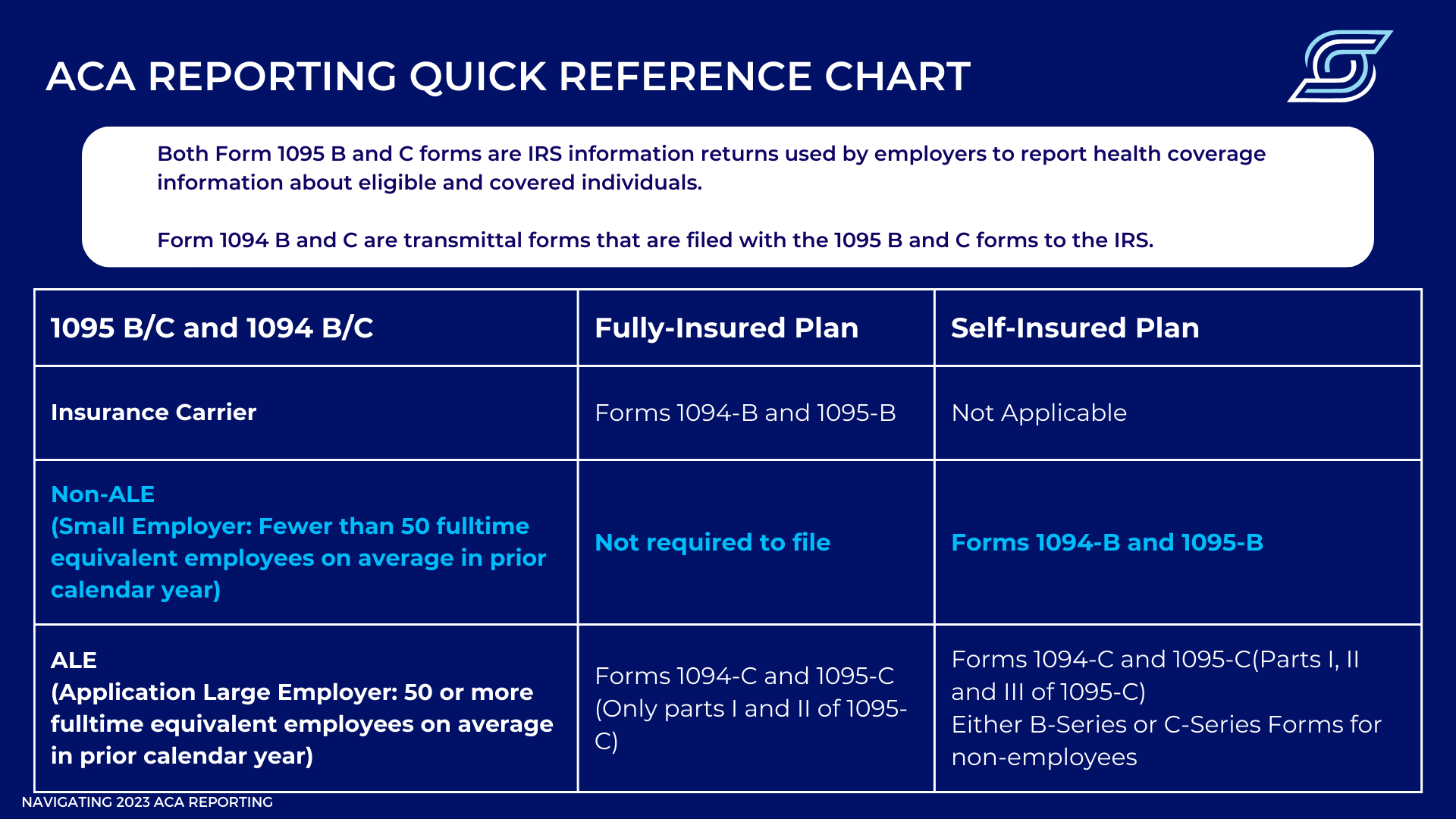

For small businesses, there's no denying the importance of prioritizing ACA reporting. An important part of this process is to opt for an ACA vendor that offers comprehensive support for filing both the 1094 and 1095 B and C forms.

About SyncStream

SyncStream maintains a tenured, knowledgeable staff who continually monitors changes to the employer mandate regulations and updates solutions as laws evolve. By outsourcing your ACA compliance to a reputable service like SyncStream's Total ACA, you can simplify the reporting process, reduce the risk of errors, file for the B forms and C forms, and ultimately save time and money. Focus on running your business while experts take care of your ACA reporting needs.