ACA Compliance: Full-Time, Part-Time and Temporary Employees

Navigating reporting with multiple different types of employee working hours can be quite challenging. Since the enactment of the Affordable Care Act, questions and debates have arisen about the impact of this law on third-party staffing arrangements. Many companies offer temporary and part-time employees lower-tiered benefits, if any. If you have employees working a variety of hours, how can you ensure your business is ACA-compliant?

We have developed this guideline to ACA compliance for full-time, part-time and temporary employees to help you understand the definitions of different employees and navigate ACA compliance.

Navigating ACA Compliance With Employee Working Hours

The Affordable Care Act requires companies that staff more than 50 full-time employees to provide their employees with health insurance. An employer that fails to provide their employees with affordable health insurance coverage must pay a penalty. For this reason, a company must determine exactly how many workers it employs. As of 2017, individuals do not have to have insurance, but requirements for employers with more than 50 full-time or full-time equivalent employees still stand.

To navigate ACA compliance, you will need to understand what workers qualify as full-time, in addition to seasonal employment laws and ACA temporary employees’ benefits.

Full-Time Employees

How can you determine if your employees are full-time? What do you need to do to be ACA-compliant if your employees are full-time workers? First, we need to look at the full-time employee definition.

What Constitutes a Full-Time Employee?

How many hours are full-time for health insurance purposes? The IRS definition of a full-time employee is an employee who works, on average, a minimum of 30 hours per week in a calendar month or completes 130 hours of service per month.

The IRS defines an hour of service as every hour for which an employee performs duties for the employer and either gets paid or is entitled to payment for the work. An hour of service also includes every hour the employee gets paid or is entitled to payment for paid time off, such as for vacation, a leave of absence, jury duty, incapacity, illness or military duty.

Employers can use the monthly measurement method or the look-back measurement method to identify full-time employees.

ACA Requirements for Full-Time Employees

Under the Affordable Care Act, full-time employees work an average of either 30 hours or more in a week or 130 hours during the month. Employers with more than 50 full-time employees must comply with ACA requirements.

Even if an employer has fewer than 50 full-time employees, they may still need to comply with ACA requirements, because the Affordable Care Act also includes full-time equivalent employees.

An employer must consider the number of hours worked by part-time employees each month to calculate how many full-time employees they would need to work those same hours. Once a company determines how many full-time equivalent employees it employs, they must combine that number with the number of full-time employees. The employer uses this total to decide whether they meet the ACA-mandated employee threshold of 50 full-time employees.

In this calculation of full-time equivalent employees, an employer does not need to include seasonal workers or employees with health coverage under a VA health program or TRICARE.

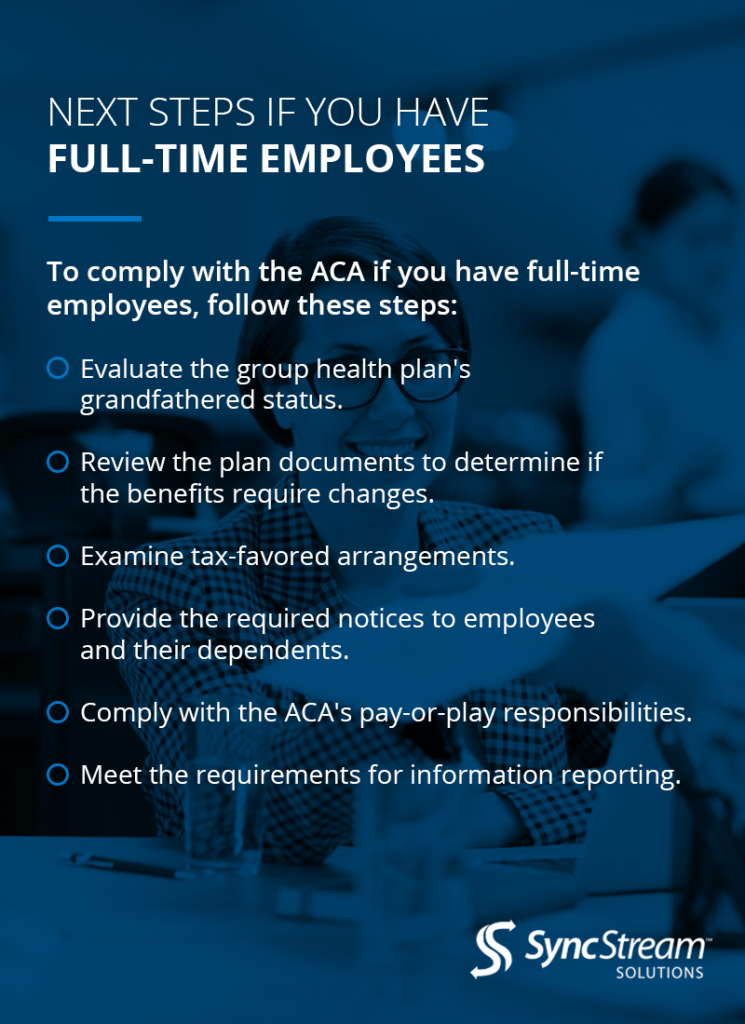

Next Steps If You Have Full-Time Employees

What are the next steps if you have full-time employees? To comply with the ACA if you have full-time employees, follow these steps:

- Evaluate the group health plan’s grandfathered status.

- Review the plan documents to determine if the benefits require changes.

- Examine tax-favored arrangements.

- Provide the required notices to employees and their dependents.

- Comply with the ACA’s pay-or-play responsibilities.

- Meet the requirements for information reporting

Variable-Hour Employees

How can you determine if you have variable-hour employees? What do you need to do to be ACA-compliant if your employees are variable-hour workers? Do you need to provide health insurance for hourly employees?

What Constitutes a Variable-Hour Employee?

A variable-hour employee is one whose hours are uncertain or irregular, making it difficult to determine whether they work at least an average of 30 hours per week.

There are several factors to consider when evaluating whether a new hire is a variable hour-employee, including:

- Whether employees who are in the same or similar positions are or are not full-time workers.

- Whether the new employee is replacing another employee who was or was not a full-time worker.

- Whether the job description or contract documents specific responsibilities, or otherwise describes the position as requiring at least 30 hours of service each week.

No one factor alone can determine whether a new hire is a variable-hour employee, and several elements may come into play.

ACA Requirements for Variable-Hour Employees

The Affordable Care Act part-time employees’ requirements state that some benefits are mandatory for every employee, regardless of the number of hours they work. The ACA mandates that employers must offer unemployment benefits, overtime payment rates and workers’ compensation benefits to both part-time and full-time employees.

Although the hours an employee works during the stability period won’t affect their status, these hours will count toward the next measurement period. During future measurement periods, changes in average weekly hours that a variable-hour employee works may change their eligibility status during subsequent stability periods.

Next Steps If You Have Variable-Hour Employees

What are the next steps if you have variable-hour employees? An applicable large employer identifies which variable-hour employees they need to treat as full-time employees by:

- Calculating the average weekly hours the employee works during a look-back measurement period.

- Locking in the status of the employee during the stablity period.

Handling the complex rules set by the ACA can be difficult for companies, which is why so many HR employees and executives turn to the experts at SyncStream

Seasonal Employees

How can you determine if your employees are seasonal? What do you need to do to be ACA-compliant if you employ seasonal workers?

What Constitutes a Seasonal Employee?

What defines a seasonal employee? Are teachers seasonal employees? The law treats seasonal employees like variable-hour employees. For a worker to be a seasonal employee, they need to work in a position for which the customary yearly employment is a maximum of 120 days.

Customary refers to the nature of the position the employee typically works for six months or fewer. The period of employment must begin at about the same time each calendar year, such as winter or summer. For example, a golf instructor at a resort may work for six months out of the year, making them a seasonal employee.

ACA Requirements for Seasonal Employees

What are the ACA seasonal employees’ requirements? An applicable large employer (ALE) that uses the look-back measurement method may not be liable for penalties due to ACA employer shared responsibility if it does not offer health coverage to its seasonal employees during the initial measurement period. This rule may apply even if these employees work full-time hours at some point, with the exception that workers use a short-cycle measurement period and these employees stay employed during the subsequent stability period.

For seasonal employees, an ALE will use the initial measurement period, even if they hire employees to work more than 30 hours a week. The normal requirement of offering health insurance by the first day of an employee’s fourth month of employment doesn’t apply to seasonal employees, even when they work more than 30 hours a week during their season of employment.

Though it is unusual, the law would continue to classify a seasonal employee as such if their employment during a particular year extends beyond the customary period.

For example, a resort may ask golf instructors who typically work six months annually to continue working for an additional month due to unusually mild weather. Under the ACA, these workers would still be seasonal.

Next Steps If You Have Seasonal Employees

To comply with the ACA if you have seasonal employees, follow these steps:

- Track seasonal hires.

- Ensure your workers meet seasonal status.

- Check and update seasonal employee information every month.

- Track seasonal employee hours.

Temporary and Short-Term Employees

How can you determine if your employees are temporary or short-term employees? What do you need to do to be ACA-compliant if your employees are temporary workers?

What Constitutes a Temporary/Short-Term Employee?

The ACA refers to temporary employees as short-term employees. These employees accept positions that are shorter than 12 months in length.

ACA Requirements for Temporary Employees

Do temporary employees get benefits under the ACA? How are ACA and temporary staffing agencies related? Unless these workers meet the requirements of seasonal employees, ACA temporary employees are not exempt from the penalties for short-term, temporary employees.

Temporary employees who do not meet the requirements for seasonal employees and who work more than 30 hours a week fall under the classification of full-time employees who are eligible for benefits under the applicable ACA rules.

Next Steps If You Have Short-Term Employees

If you have short-term employees, track employee hours with SyncStream to save your company time and resources. No one wants to scramble to find the right information before it’s time to file. For staffing agencies, this can be particularly challenging. To track and appropriately record hours worked by your employees, consider investing in SyncStream.

Employee Hours FAQ

Below we answer some of the frequently asked questions we receive from clients about employee hours.

How Do I Calculate My Employees’ Hours?

As an employer, you will need to determine full-time employment hours using either the monthly or the look-back measurement method.

Monthly: Under this approach, the employer can calculate an employee’s hours on a month-by-month basis. If an employee works at least 130 hours each month or at least 30 hours per week in a calendar month, they are a full-time employee. Hours of service also include paid time off, such as for sick time, vacation time, jury duty or leave of absence.

Look-back: Under this method, the employer can figure the number of hours an employee worked in the preceding period. Companies cannot use this approach to determine whether a worker is a full-time employee for defining ALE status.

To calculate your number of full-time equivalent employees, use the following steps:

- Combine the total hours worked for the month by all your non-full-time employees. You do not need to include more than 120 hours per employee.

- Divide this total number of hours by 120.

For example, a company has 30 full-time employees for every calendar month and 30 part-time employees for every calendar month. Every part-time employee works 60 hours per month.

The combined hours of work for the company’s part-time employees is 1,800 (30 x 60).

Divide this total number of hours by 120 to get 15.

This company has 15 full-time equivalent employees for every month. Add this number to the number of full-time employees (15 + 30) to get a total of 45. Since this company has 45 Affordable Care Act full-time employees, it is not an applicable large employer.

Can I Exclude Hours Worked for Any Employees?

Are there any hours worked by any employees that you can exclude? Employers may not have to track or count hours worked for volunteer employees, student employees or teachers and adjunct faculty members.

Volunteer Employees

You can exclude hours worked by bonafide volunteer employees. The law defines bonafide volunteers as employees of a tax-exempt organization or governmental entity whose only form of compensation comes in the form of an allowance or reimbursement for reasonable expenses, or in reasonable benefits and nominal fees connected to the volunteer service.

Student Employees

A company does not need to count hours performed by students in subsidized positions through a federal or state work-study program. However, if a student employee gets paid or is eligible for payment beyond the federal or state work-study program, these hours must count toward determining benefits eligibility.

Members of Religious Orders

Specific circumstances permit an hour of service not to count if performed by a person who is subject to a vow of poverty under a religious order. The employee needs to be a member of the religious order, and the employee must perform tasks typically required of that order’s active members for the exclusion to apply.

Teachers and Adjunct Faculty

Since compensation usually doesn’t tie directly to a teacher or adjunct faculty member’s number of hours worked, these employees can present challenges to employers. For instance, compensation often links to hours in the classroom and not to hours worked outside the classroom, such as time spent on grading papers and tests, preparing lessons and counseling students.

The law currently requires employers to use a crediting method for hours of service worked by teachers and adjunct faculty members.

Do I Count New Hires in Employee Numbers for This Calendar Year?

Should an employer take all employees into account when determining if they are an ALE? Typically, every worker counts as either a full-time employee or a full-time equivalent employee when figuring whether an employer is an ALE. There are some exceptions, however, such as the following.

Seasonal employees: Employers are not applicable large employers if the workforce of the employer is more than 50 full-time employees for 120 days or fewer in the previous calendar year and all the employees above the 50 full-time employed workers are seasonal workers employed for no more than 120 days.

Employees with VA/TRICARE coverage: Employees with coverage under a VA health program or TRICARE do not count toward determining whether an employer is an ALE.

If you hire additional employees, including part-time employees, during this calendar year, you will count them when determining if you are an applicable large employer for the next calendar year. You can use the full-time equivalent employee calculator to help you determine the number of full-time equivalent employees you have.

What Happens If I Don’t Report Employee Hours Correctly?

What are the consequences if you do not report employee hours correctly? You must pay a penalty if you are an eligible employer and the following circumstances apply:

- Your company does not offer health insurance to at least 95% of full-time employees.

- At least one of your full-time employees received a cost-sharing subsidy or premium tax credit in the federal or state Marketplace.

You must offer coverage that provides minimum value and is affordable. Coverage is affordable if the required contribution from the employee is not more than 9.02% in 2025 of the employee’s household income. For a plan to provide minimum value, it must cover at least 60% of a standard population’s covered health care expenses.

Bogged Down With ACA Requirements? SyncStream Takes Away Reporting Stress

At SyncStream, a Selerix Company, we take the pressure off our clients by ensuring they remain compliant and providing all the reporting assistance our clients need.

Please join our webinar on this topic, Back to the Basics Series 1- Navigating ACA Employee Classifications: Full-Time, Part-Time, and Seasonal Workers. Please join us for this beginner-friendly webinar as we go back to the basics of

ACA Employee Classifications.

This is essential as summer employees start.

June 19, 2025

11:00 AM (CT)