Missed the ACA Deadline? Find out what to do now.

Missed the ACA Deadline? Find out what to do now.

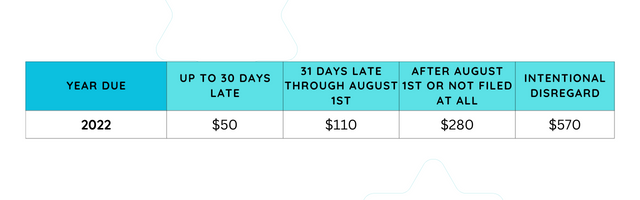

Organizations had until the filing deadline on March 31st to submit Form 8809 and obtain a 30-day extension automatically. Nevertheless, if the deadline has passed, filing late is still preferable to not filing at all, as it will incur a lower penalty.

There is no “good faith effort” relief for failing to file in a timely manner.

The IRS is actively pursuing Applicable Large Employers (ALEs) who failed to file their Forms 1094-C or 1095-Cs in tax years 2015 – present (Letter 5699) and ALEs (or non-ALEs with self-funded plans) who failed to timely file Forms 1094 or 1095, had incomplete or inaccurate information in their Forms 1094 or 1095, or failed to electronically file their forms 1094 and 1095 (if they have more than 250 employees).

The IRS has stated that penalties for noncompliance with the Employer Shared Responsibility Tax have no

statute of limitations on when the IRS can impose them. This means that employers are never “safe” or “out of the woods” from receiving penalty letters, even from the very first reporting season, which happened in the spring of 2016.

SyncStream is experienced with clients that need to file late or for any past year.

About SyncStream

SyncStream removes the burden of ACA compliance and reduces your company’s risk of high IRS fines and penalties. Subject matter experts utilize SyncStream’s user-friendly compliance software to track employee hours, auto-populate forms, audit forms, and e-file for thousands of ALEs.

SyncStream can help simplify the process with their Full Service Total ACA solution, which includes tracking employee hours, auto-populating forms, auditing forms, and e-filing for thousands of ALEs. Don't risk high IRS fines and penalties; trust SyncStream to handle your ACA compliance needs.