ACA Reporting for 2020 Just Got More Complicated!

Blog / By Arthur • June 28, 2022

ACA Reporting for 2020 Just Got More Complicated!

Blog / By Arthur

This year has been an odd one to say the least. We have seen one unprecedented situation unfold after another and it is unclear if there is an end in sight. For employers that are struggling to decide whether to lay off employees, comply with state and local ordinances that change from week to week, and possibly how to fund the next payroll cycle Affordable Care Act (ACA) compliance may not seem like a real concern, or just a minor one in the back of an employer’s mind.

However, if gone unaddressed ACA noncompliance could produce a knockout blow (financially speaking) just at a time where employers may be getting back on their feet financially.

Employers have found some relief from the CARES Act funding of the Small Business Administration’s (SBA) Paycheck Protection Program (PPP) and Emergency Disaster Relief Funds. As employers continue to navigate the uncertain landscape many are just trying to stay afloat until a more “normal” economy can reopen and they can return to their normal state as well. Now imagine a more stable economy and restored financial capacity and suddenly receiving an enormous penalty letter from the Internal Revenue Service (IRS). That would be devastating to any employer and could be the straw that breaks the camel’s proverbial back.

Penalty Review

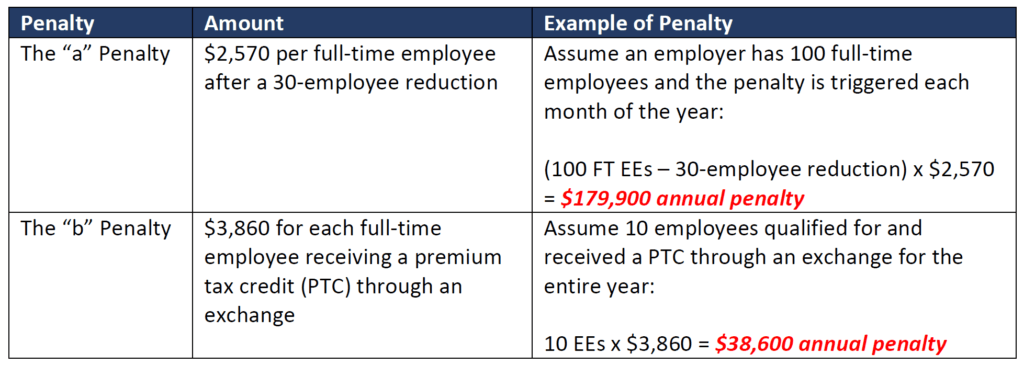

It is important to remember that ACA penalties are no small slap on the wrist. They carry a significant financial sting. As a simple reminder, there are two types of ACA noncompliance penalties. Employers can face a penalty if:

4980H(a) – The “a” penalty: They did not offer minimum essential coverage (MEC) to at least 95% of their full-time employees (and their dependents) and at least one of their full-time employees was certified as being allowed the Premium Tax Credit (PTC); or

4980H(b) – The “b” penalty: They offered MEC to at least 95% of their full-time employees (and their dependents), but at least one of their full-time employees was certified as being allowed the PTC (because the coverage was unaffordable or did not provide minimum value, or the full-time employee was not offered coverage).

The amounts for each penalty increase from year to year. In 2020 the penalty amounts will be the highest they have ever been. They are as follows:

As you can see from the examples above, a small to mid-size employer could have a huge financial burden dropped on them if they fail to stay compliant.

2020 Expanded Draft Forms

As if it were not enough to simply have to worry about maintaining ACA compliance while managing an abundance of new responsibilities arising out of a worldwide pandemic the IRS decided that this was the time to increase the complexity of an already convoluted reporting requirement. To anyone that is lucky (sarcasm) enough to be responsible for their employer’s ACA compliance and reporting, you already know that the most complex piece of completing and filing the 1095-C form are Lines 14, 15, and 16. Lines 14 and 16 require the employer to select the most accurate “Indicator Code” which expresses the offer of coverage and subsequent safe harbor relief for the employer that was, or was not made to the employee. This form then gets provided to the employee and to the IRS. It is ultimately what is used to determine noncompliance by the IRS and used to calculate penalties that an employer may owe. Up until now, there were ten Indicator Codes that an employer needed to select from to complete Line 14. This is no easy task and getting it wrong could lead to potential penalties for filing an inaccurate tax document (more penalties!). In light of all of this, the IRS has added an additional eight Indicator Codes to an employer’s Line 14 options, brining the total to eighteen (18)! See below:

These new indicator codes were prompted by the Trump administration’s expansion of Health Reimbursement Arrangements (HRAs). Last year the administration proposed and finalized new rules that would allow HRA’s that met certain conditions to be considered minimum essential and affordable coverage related to ACA compliance. However, HRAs are night and day to what MEC coverage was considered under the ACA’s definition prior to this administrative change, which is why a new class of indicator codes is almost necessary for the government to track the actual type of coverage being offered to employees. More information and guidance will certainly be coming from the IRS on the indicator codes and all aspects of the draft forms, but I think it is fair to say that employers will have their hands full with these significant changes.

Practical Issues Related to Tracking and Reporting

These 2020 form changes were somewhat expected, but certainly not to the level or extent that have been proposed in the draft forms the IRS have dropped. Beyond this complication there are also many practical issues related to the pandemic that will create problems for employers on their journey to compliance. For example, employers that furlough employees or reduce hours may need to properly identify the change in status in the tracking process, and subsequently in what is being reported to the IRS. If employers do happen to layoff employees and possibly rehire them as the economy picks back up this too can impact an employee’s status related to employee tracking. There are very specific rules related to rehire and how employees are treated if rehired within a certain timeframe. This is referring to breaks in service and the 13-week rehire rule. These nuances existed before; however, they will be magnified during this constantly evolving situation and the potential for error is dramatically increased. These are all things that employers will need to be prepared to handle in order to remain compliant.

Conclusion

Overall, 2020 has been a year full of challenges for employers. It is likely that the challenges will continue throughout the course of the year. Employers need to be smart and diligent about remaining apprised of any and all changes that take place. This includes changes to state and local ordinances, legislative opportunities such as new SBA loans, and compliance changes such as the 2020 draft 1095-C forms. As an employer you should look to your service provider to help you manage these changes and stay compliant. They can play a major role in keeping you on track and avoiding major penalties.

If you’ve ever found yourself squinting at ACA terms that read more like acronym soup than common sense, you’re not alone. For many employers, keeping up with the Affordable Care Act still feels like navigating a maze — one lined with confusing terms, shifting standards, and high-stakes consequences. The frustration is real. So is the risk.

If you thought last year’s compliance season was a challenge, buckle up. 2025 is already shaping up to be a regulatory rollercoaster, with HR teams in the front seat. Executive orders are emerging, ACA reporting requirements are shifting and IRS scrutiny is on the rise. And that’s just the stuff we know about.