ACA Reporting Penalties and IRS Letters

Blog / By Arthur

- Noncompliance

- Late Filing

- Failure to file

- “Potential” noncompliance

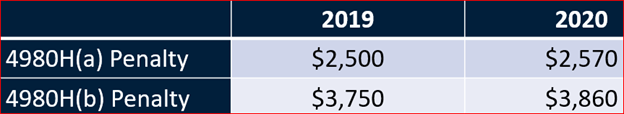

2020 4980H(a) Penalty

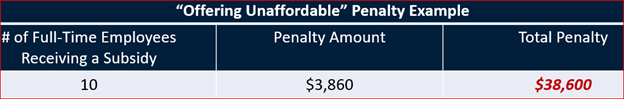

$3860.00 per form for offering “Unaffordable” Coverage for 2020

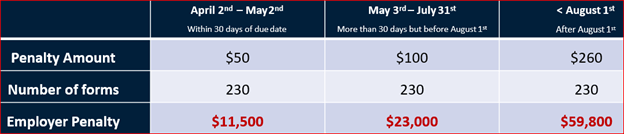

Late Filings increase the longer you wait!

How to Stay ACA Compliant

To protect your organization from costly fines, you need to meet the requirements outlined in the ACA. Here are a few tips to help you stay in compliance.

Offer Affordable Health Insurance

To stay in compliance, ALEs must offer affordable health insurance to at least 95% of their full-time employees. A full-time employee is someone who works 30 hours per week or more on average, or 130 hours per month. To avoid penalties, make sure you offer insurance to the required number of full-time employees. An affordable plan is one that even your lowest-earning employee can afford.

Fill Out 1094 and 1095 Forms Accurately

The IRS will reject incomplete and incorrect 1094 and 1095 forms. To avoid penalties, ensure the information you enter is correct and up to date. If you’re not sure whether you have accurate employee demographic information, ask workers to confirm.

File Your Returns on Time

You may face penalties if you fail to file your returns on time — even if you’ve met all other ACA requirements. Check the deadlines for the year you’re filing and remember that paper filing and e-filing deadlines may differ.

Preparing for an IRS Audit

If the IRS finds ACA reporting mistakes, irregularities or other “red flags” when reviewing your business’s tax returns, it could decide to conduct a comprehensive audit. Factors that might trigger an audit include vague, nonspecific information and a workforce with unpredictable work hours, especially if there are multiple employees who don’t meet the 130-hour-per-month threshold required for ACA coverage eligibility.

Should you receive an audit letter from the IRS, it will likely request documentation. You can ensure readiness for an audit by implementing sound record-keeping practices that include maintaining the following documents:

- Records of the steps you’ve taken to meet ACA requirements

- Contracts with your health services provider

- Copies of notices such as those related to grandfathered status or the enrollment of children until they reach age 26

How to Handle ACA Reporting Penalties

What happens if the IRS audit findings conclude you’re not in compliance and must pay the shared responsibility penalties? It will notify you by sending Letter 226J. If you don’t reply within 30 days, the IRS will assume you agree with its findings and you will need to pay the penalty.

Your options when receiving Letter 226J include:

- Pay what you owe: If you agree with the IRS’s determination, your only recourse is to pay the requested amount. You can either notify the IRS of your intention to do so or wait for it to send another letter outlining your payment options.

- Dispute the findings: If you believe that the IRS made an error and penalties should not apply, you must respond with acceptable proof, such as copies of Form 1094-C and 1095-C. You should also request assistance from your health plan provider.

Avoid Penalties With SyncStream’s Solutions

At SyncStream, we have developed an easy-to-use, cloud-based solution to help companies avoid ACA reporting penalties. Our solution organizes the data you need and automatically populates 1094 and 1095 forms to prevent errors and make meeting deadlines easier. With our full-service option, you can receive support throughout the filing process. Our ACA Audit solution assists companies with their IRS penalties. Our ACA Audit determines your business’s compliance by analyzing filing data and assessing liabilities and expected penalties. Find out how SyncStream’s solutions could help you achieve ACA compliance by contacting us online today.