Navigating ACA for Applicable Large Employers: Beyond Penalties, Unveiling Its True Significance

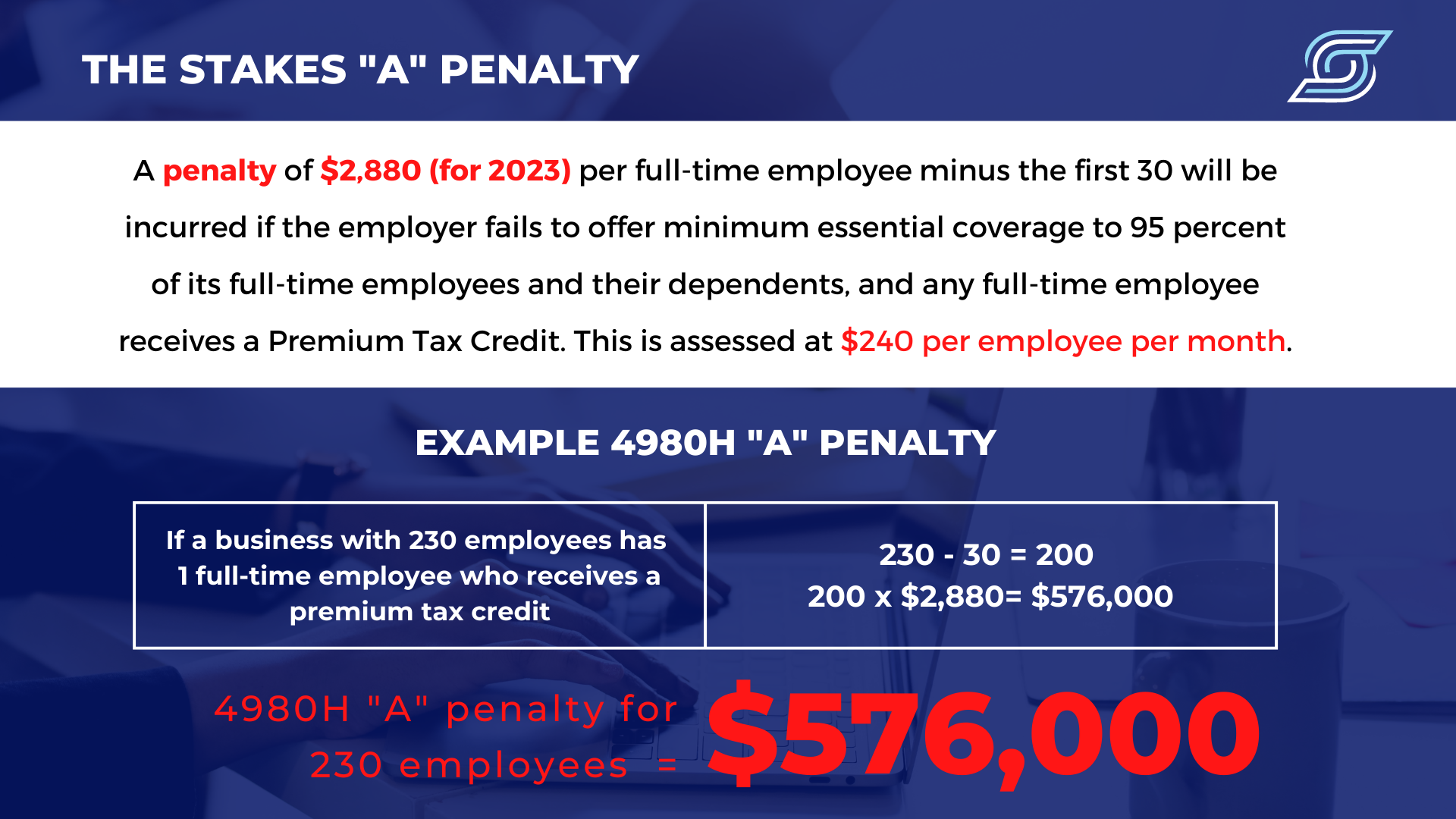

- 4980H(a) - Failure to offer at least minimum essential coverage to at least 95% of eligible employees and their dependents

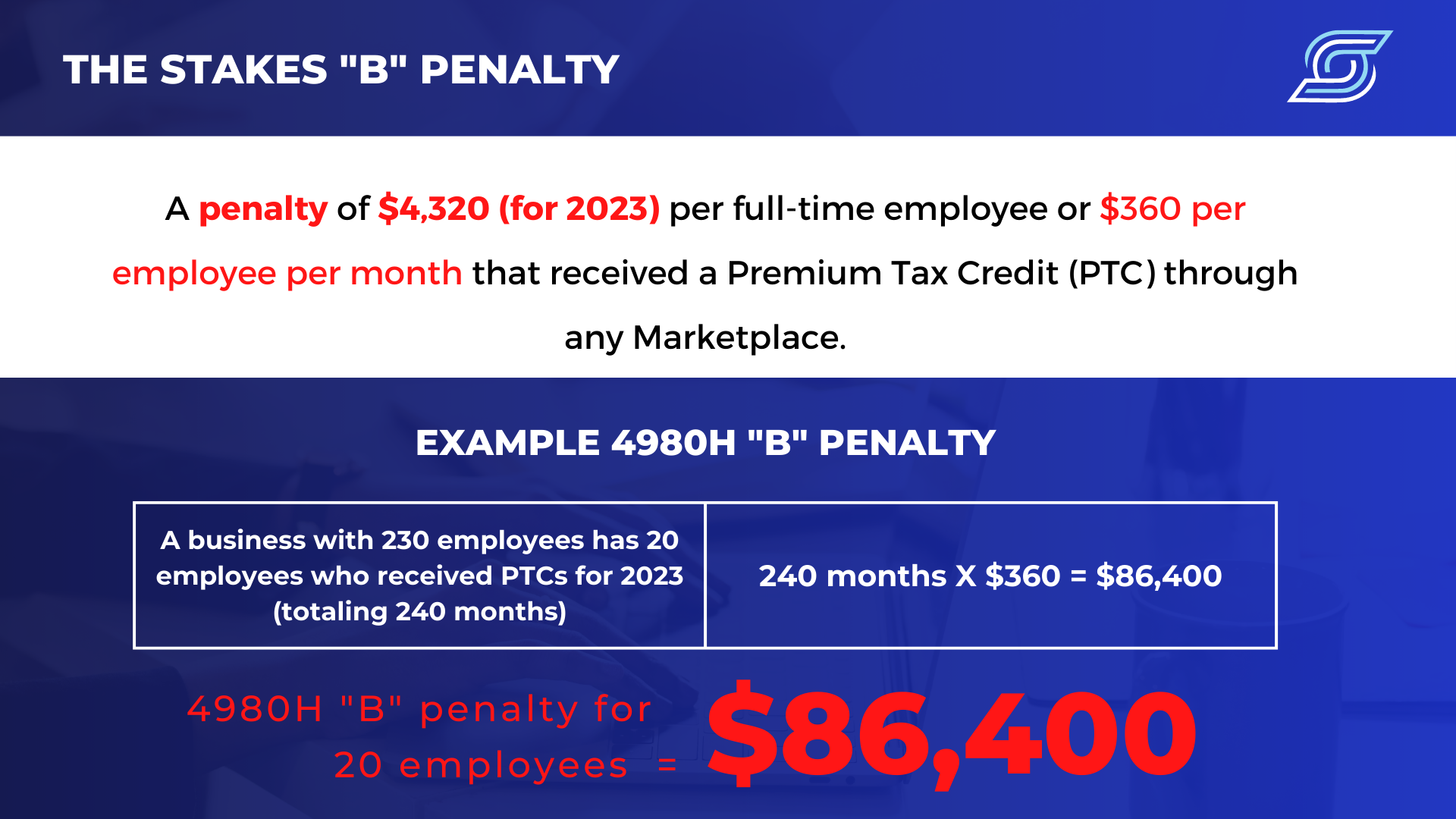

- 4980H(b) - Failure to provide affordable, minimum value coverage to an eligible employee

Importance of Compliance

A. Legal and Financial Implications: Non-compliance with the ACA can result in hefty penalties, also known as "employer shared responsibility payments." The penalties are calculated based on the number of full-time employees and can be substantial, especially for large organizations. Think in terms of hundreds of thousands of dollars.

B. Employee Well-being: Offering affordable and comprehensive health insurance is not just about avoiding penalties. It's also about taking care of your employees, who are the backbone of your organization. Health insurance can help protect your employees from high medical costs, ensure they have access to necessary healthcare services, and contribute to their overall well-being and job satisfaction.

C. Employee Retention and Recruitment: In the current overly competitive job market, offering health insurance can make your organization more attractive to potential employees and help retain existing ones. Many job-seekers consider health benefits as a crucial factor in their employment decisions.

D. Productivity and Performance: Healthy employees are more productive and engaged in their work. By providing health insurance, you're investing in the health of your workforce, which can translate to improved performance, reduced absenteeism, and a more productive work environment.

Staying Compliant

Compliance with the ACA involves several steps, including determining your ALE status, offering compliant health insurance, and reporting to the IRS. Here are some tips for staying compliant:

A. Regularly Review Your ALE Status: Your ALE status can change from year to year based on the size of your workforce. Make sure to regularly assess your status and adjust your health insurance offerings accordingly.

B. Understand the ACA Requirements: Familiarize yourself with the ACA requirements, including what constitutes affordable and minimum essential coverage.

C.

Keep Accurate Records: Keep detailed records of your employees, their work hours, and the health insurance coverage you offer. This will be crucial for IRS reporting and in case of an audit.

D. Seek Professional Assistance: Navigating the complexities of the ACA can be challenging. Consider seeking assistance from professionals who specialize in ACA compliance. Be sure that any compliance software you utilize is staying up to date with both past and current regulations, not all software is created equal.

In conclusion, ACA compliance is essential for ALEs, not only to avoid legal and financial repercussions but also to ensure the health and well-being of their employees. By understanding the ACA requirements and taking the necessary steps towards compliance, employers can contribute to a healthier and more productive workforce.

About SyncStream

SyncStream has been e-filing for businesses since the inception of the Affordable Care Act with a tenured staff of ACA knowledge experts. For assistance with electronic filing, ACA compliance, and penalty assistance,

contact Syncstream. ACA Compliance needs can be simplified with SyncStream’s

Total ACA

which includes electronic delivery.