Insights into ACA reporting for PEOs

ACA Reporting Software Is a ‘Lifesaver’

Companies striving to offer top-tier human resource services and employee benefits turn to Professional Employer Organizations (PEOs) for support, and the escalating growth of the PEO industry underscores their pivotal role. In response to the increasing complexity of government regulations, PEOs are exploring strategies and solutions to reduce risk to door-closing penalties before their cleints are caught in a bind.

One of these strategies includes ACA tracking filing on behalf of their clients. The Affordable Care Act (ACA) establishes precise parameters for essential employee healthcare plans, posing a challenge for smaller enterprises. Professional Employer Organization (PEO) emerges as a pragmatic solution for small businesses grappling with ACA requirements.

The Pain Points for PEOs

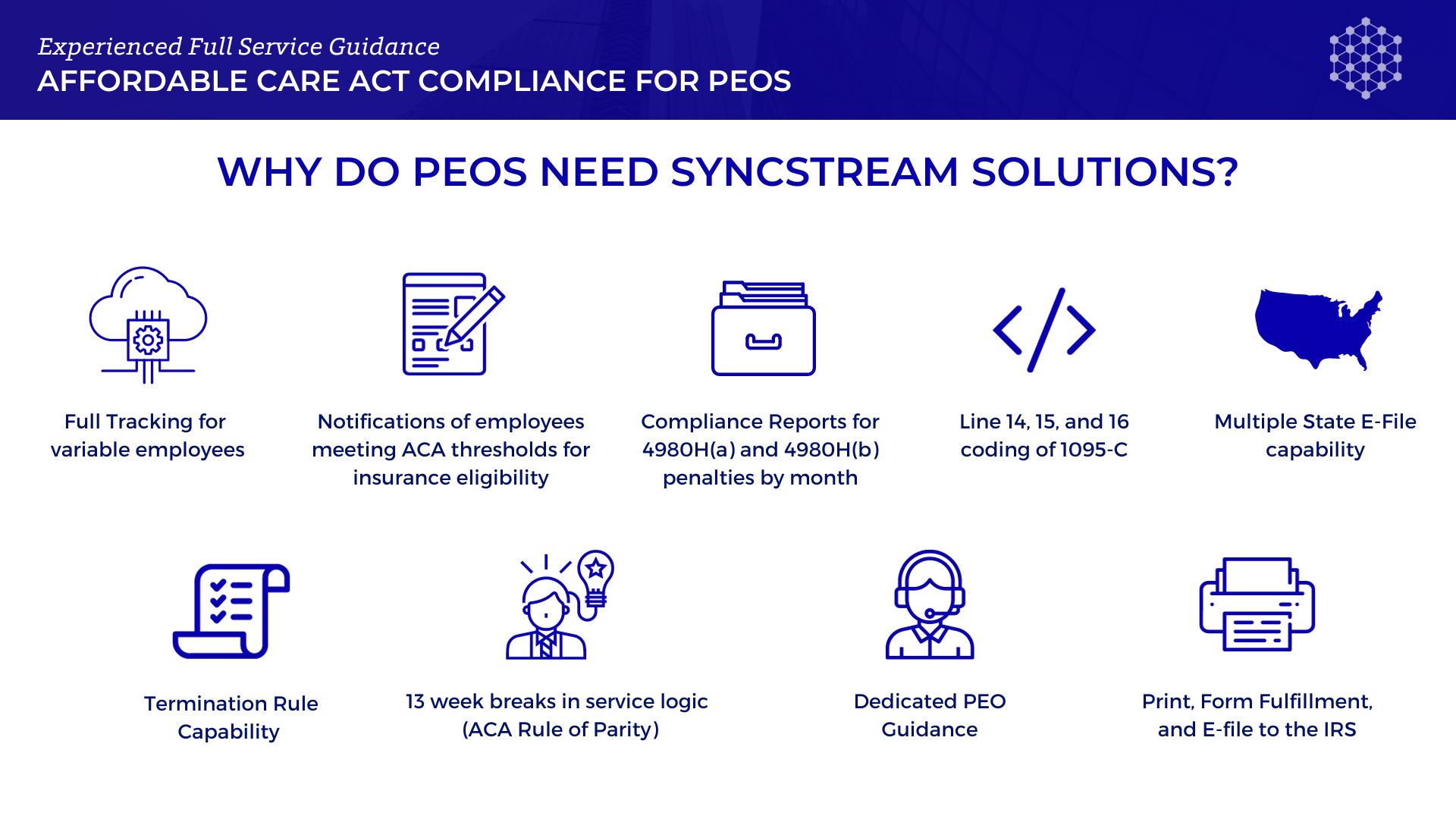

ACA reporting can pose several pain points for PEOs. Some of the common challenges faced by PEOs in managing ACA compliance for their clients include:

- Not having a single sign-on third-party software or a seamlessly integrated solution to keep track of each PEO client

- Auto-notifications of employees meeting ACA thresholds (variable hour employees tracking can be difficult)

- Annual coding and specs for 1095 / 1094 Forms

- Pre-audit of forms for potential penalties prior to filing with the IRS

- Notification of transmission & acceptance of documents by IRS to each client

- Audit trail including a receipt ID from the IRS/State, and distribution of forms to applicable parties

- Not having a dedicated ACA Customer Support specialist

Also, the cost implications associated with ACA reporting can be burdensome for PEOs. Investing in advanced technology, compliance expertise, and staff training is essential but can strain financial resources.

Moreover, the evolving nature of ACA regulations adds a layer of complexity. PEOs must stay abreast of legislative changes, updates, and nuances in reporting requirements to ensure ongoing compliance for themselves and their client businesses.

The Burden on Employers

Internal Revenue Service (IRS) tax codes and healthcare compliance are among the most significant challenges for business owners, particularly small businesses. The Affordable Care Act (ACA) regulations are considered “overly burdensome” by 53% of respondents in a Benefits Pro survey.

This shouldn’t be surprising, as the ACA has some of the most intricate employer reporting requirements. This complexity is where PEOs can step in and provide maximum healthcare compliance coverage by incorporating reporting software into their tech stacks.

A PEO client shares her experience using one of these solutions, HRlogics’ SyncStream. “My confidence level has increased tremendously since we started working with the SyncStream team. SyncStream has helped prevent our company from paying out IRS penalties because the software will alert us about any issues in our reports. The team also trained us on ACA compliance knowledge so we know what to do right if issues arise, unlike other solutions.”

She adds that “Having the right partners in place, like SyncStream, has been critical to my success.”

The Value of Partnerships

A PEO and an ACA solution provider partnership can yield several benefits. Firstly, ACA compliance is a nuanced and ever-evolving landscape, and having a dedicated solution provider ensures that the PEO stays updated on regulatory changes, reducing their clients' risk of non-compliance and penalties.

Integration with an ACA solution provider streamlines the reporting process for the PEO. These providers often offer specialized software and tools that automate data collection, ensure accuracy in reporting, and facilitate timely submissions. This not only enhances efficiency but also minimizes the potential for errors that could arise in manual reporting.

Moreover, the partnership allows the PEO to leverage the expertise of the ACA solution provider. Navigating the complexities of ACA regulations requires specialized knowledge, and having a reliable partner ensures that the PEO can tap into this expertise, staying ahead of compliance challenges.

Additionally, a partnership with an ACA solution provider can enhance the overall service offering of the PEO. It demonstrates a commitment to providing comprehensive solutions to client businesses, instilling confidence in the PEO's ability to manage complex regulatory requirements effectively and thereby reducing their clients risk.

In summary, collaborating with an ACA solution provider empowers a PEO to navigate the intricacies of ACA compliance more efficiently, stay current with regulations, reduce errors, and enhance the overall value proposition for client businesses.

- Stay ahead of changing requirements. A dedicated solution provider ensures PEOs stay informed about regulatory changes, reducing the risk of non-compliance and penalties.

- Streamlined reporting processes. PEOs can streamline their reporting process by integrating with an ACA solution provider. These providers often offer specialized software and tools for automating data collection, ensuring accurate reporting, and aiding in timely submissions. As a result, this improves efficiency and minimizes errors that might otherwise occur.

- Leverage expert knowledge for maximum compliance. Partnerships allow PEOs to leverage the expertise of the ACA solution provider. Navigating ACA regulations demands specialized knowledge. A reliable partner enables PEOs to access this expertise, helping their clients maintain compliance.

- Retain clients longer. Partnering with an ACA solution provider enhances PEO service offerings and showcases a commitment to comprehensive solutions for client businesses. This instills confidence in the PEO's ability to effectively manage complex regulatory requirements.

Another PEO client raves, “SyncStream saved my life! There was so much confusion about all the rules, and SyncStream ensured we were doing everything correctly. SyncStream has been helpful, saving a lot of money and time.”

A Stable Choice for an Uncertain Future

Healthcare’s continued uncertainty makes it both a valuable asset and a risky endeavor. Intelligent solutions and informed professionals are the best ways to help employers with compliance needs. Partnering with a company like HRlogics, with all the infrastructure to help employers already set up, can make a massive difference to your customers and make your PEO a more valuable asset.

Beth Eckert adds, “Keeping up on compliance and having SyncStream as a partner has given Pinnacle confidence in remaining in compliance with the ACA.”

PEOs can significantly benefit from partnerships with compliance-focused solutions providers like HRLogics’ SyncStream. These partnerships can help manage healthcare compliance solutions, add a valuable service for customers, and help mitigate the risk of healthcare regulations for the PEOs while still passing along those highly valued benefits to the customers.

About SyncStream

SyncStream's Chief Legal Counsel along with its' tenured, knowledgeable staff continually monitors the changes to the employer mandate regulations and updates solutions as laws evolve. SyncStream removes the burden of ACA compliance and provides penalty risk assessments and suggested corrections to reduce the PEO's client's risk of high IRS penalties. Subject matter experts utilize SyncStream’s user-friendly compliance software to track employee hours including enhanced variable hour tracking as well as the logic to track the 13 week breaks in service rules, auto-populate forms including all of the codes, audit forms, and e-file for thousands of ALEs. SyncStream’s Full Service Total ACA solution can simplify your ACA compliance needs.

Join us on November 16th at 11:00 AM (CDT) for an insightful webinar that offers crucial insights into ACA reporting for PEOs. Host Sean Cooper will discuss key deadlines, an overview of ACA reporting requirements for PEOs, common challenges, best practices for ACA data collection, and tools and resources to streamline the process. — Register to save your spot!